Disney lives in America. Time Warner, one of the largest studios in Hollywood, launches HBO Max. Netflix faces new competition from other streaming platforms such as YouTube, Amazon, Apple and more. If so, in what way?

To comment on Netflix’s strategy to ensure success ahead of this new contest, we interviewed Ankur Sawda, a newly arrived lecturer in the strategy and business policy group at HEC Paris. A recent study by Ankur Chawda uses Netflix’s success to show how incentives can drive innovation in organizations.

What has changed on Netflix?

The Netflix strategy can be simplified to get more content, make them more subscribers, prevent their content, and make sure that Netflix still has more content. Investors expected the benefits of Netflix content to be great, and the library creates its content at any new entrance and does not win Netflix clients. Once subscriber growth is over, Netflix will be able to lower its content costs and be able to price it so that it can benefit indefinitely from subscription fees.

What has changed this expectation is the heavy investment that the current U.S. networks are making in the subscription offer. Investors aren’t sure if Netflix’s successful and profitable future will come true.

What challenges will Netflix’s competitors face?

Competitors must overcome the difficulty of attracting existing Netflix customers or consumers who may not yet have a streaming service. For existing Netflix customers, the additional cost of an additional subscription needs to be justified, which can be difficult because Netflix already offers so much content to those customers. Consumers who don’t already have a streaming service need a better offer than Netflix’s current offering because Netflix still can’t convert them into customers.

A service like Apple TV + combines streaming service with another product, effectively increasing the customer’s willingness to pay for each individual product and helping the service attract customers. However, creating a streaming service is expensive, and it is unclear whether the resulting increase in customer revenue justifies the cost.

Disney + can be quite different from the content on Netflix to guarantee another subscription from an existing Netflix client, or to convince a non-streaming client to sign up. This could be good for Netflix. The market supports many revenue stream providers. The challenge for Disney is whether Disney + can monetize its content better than Netflix. Otherwise, the company would be better off discarding Disney + and instead licensing content to Netflix. Disney + is an external option that uses licensing terms that favor Disney over the real competitor Netflix.

What is Netflix’s biggest threat?

YouTube does not pay for content development and is free for consumers. It’s also easy for Netflix subscribers to watch YouTube, unlike its competitor, which pays an additional subscription fee. I’m not sure Netflix has a winning strategy against YouTube. Lowering prices due to competition can not only discourage customers from watching YouTube, but also negatively affect overall profits.

The high price makes viewers watch exclusively on YouTube, and it is natural not to pay for subscription content. Why Netflix is different when it comes to password sharing. Microsoft had the same problem with Windows: preventing theft in Windows helped drive Linux adoption. If the client is running Linux, it is difficult to convert back. Netflix should officially ban passwording so customers don’t pay for its service, but should unofficially ignore it.

What does the success of NETFLIX mean for French companies like CANAL +?

Netflix is an opportunity for a company like Canal + that recognizes the value of spreading French cultural content around the world more than traditional American networks. Netflix can increase Canal + ‘s international content revenue and benefit from the artisans and actors involved in content production in France. But if Netflix starts funding French content independently of Canal +, it could pose a threat to Canal +. If French consumers have access to high-quality French content without Canal +, the price of Canal + will go down. Canal + needs a strategy to maintain its dominant position in French content.

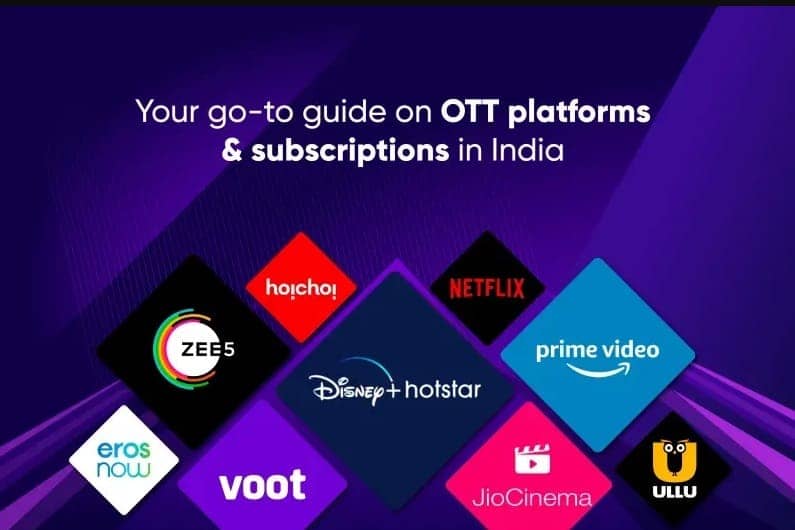

Netflix posted a big earnings miss as it reported that it lost 200,000 subscribers in the January to March quarterly window, the opposite of the constant growth it wants to see. That was actually more pronounced in the US and Canada where it lost 640,000 subscribers in the quarter, offset by gains in the Asia Pacific market.

Wall Street analysts can parse their own reasons for these losses, but if you’ve used the service and its competitors recently, you’ll know that the answer is pretty clear. Netflix absolutely has the numbers and market share advantage here. Even with the unexpected loss, they still have 221.6 million worldwide subscribers, with about 75 million in the US and Canada.

That is still far more than rivals have reported. Hulu has 45.3 million while HBO and HBO Max have 46.8 million subscribers. Disney Plus has 42.9 million subscribers in the US and Canada. Paramount Plus has 32.8 million subscribers. Apple, on the rise with arguably the highest quality content lately, has only 8.1 million subscribers via the last analyst estimates.