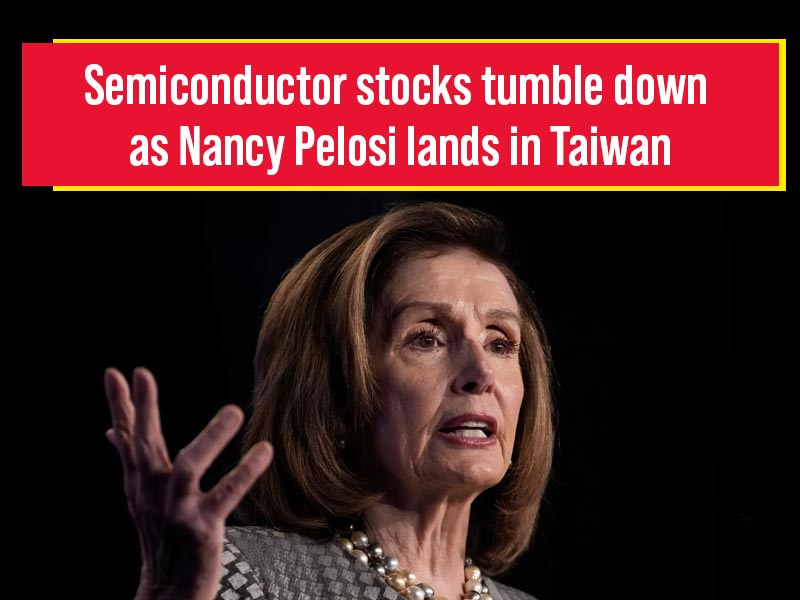

The geopolitical crisis between the United States and the People’s Republic of China over the recognition of Taiwan (ROC) has begun to weigh on shares of the major semiconductor industry.

Stocks began to fall when news broke that US Congress Speaker Nancy Pelosi would visit Taiwan. China, which is of the stand that Taiwan is part of the country, has vehemently opposed the move by Nancy Pelosi to visit the island and even threatened to use the military.

Taiwan Semiconductor Manufacturing Co Ltd, famously known as TSMC is a pioneer in the field of developing and manufacturing semiconductors.

Founded in Taiwan 35 years ago, TSMC is currently the largest multinational corporation in Taiwan with annual revenues of more than $57 billion and a workforce of more than 65,000.

The company is currently listed on the New York Stock Exchange and the Taiwan Stock Exchange. In addition to TSMC, Taiwan has United Microelectronics Corporation, another company that focuses on semiconductor development and manufacturing.

How do stocks react to the arrival of Nancy Pelosi? Shares of TSMC on the Taiwan Stock Exchange (also known as the Taipei Stock Exchange) fell nearly 2.38 percent to NT$492 per share.

While TSMC fell 2.3%, its peer United Micro Electronic Corporation fell 2.98% to close at 39.10. Taiwan’s FTSE TWSE Taiwan 50 lost 161.51 points to close at 11,403.41.

Shares in Semiconductor Manufacturing International Ord Shs, China’s largest semiconductor maker, fell on Tuesday. Shares in Hong Kong-listed Semiconductor Manufacturing International Ord Shs fell nearly 3.48% to HK$15.54 a share.

It is worth noting that the Hong Kong government supported China with the arrival of House Speaker Nancy Pelosi to Taiwan on Tuesday evening.

In the Western world, shares of NXP Semiconductors, a Dutch-American semiconductor manufacturer based in the Netherlands, fell on Tuesday.

Shares of NXP Semiconductors, listed on Nasdaq as NXPI, were trading at $180.83 per share at 15:37 GMT on August 2. This is 1.89% below the previous close.

Another American semiconductor company, Texas Instruments Incorporated, lost nearly 0.6 percent of its stock value due to the global impact of Nancy Pelosi’s decision.